Loan Against Property Services, Pan Card, 200000, ID 23080381462

Loan Against Property EMI calculator is an online tool that calculates the monthly instalments to be paid towards the loan amount. The calculator gives accurate results on the basis of relevant details, such as loan amount, interest rate and loan tenure.

Loan Against Property Best loans, Loan, Print ads

As the name implies, a home equity loan allows you to borrow money against the equity you've built in your property. With a home equity loan, you can borrow a lump sum of cash up front, and.

Loan Against Property Mortgage Loan Apply Now Call +91 7503211000

Secured loan (also called a 'homeowner loan', or 'home equity loan'). These are fixed-term loans, secured against an asset (usually property, but some lenders accept other high-value assets too). Second mortgage (also called 'second charge mortgage'). This is a separate loan agreement to your first mortgage, so you make monthly payments towards.

two people shaking hands over a small house with the words your managed property is in safer

Every mortgage comes with certain terms that you should know: Loan amount. This is the amount of money you borrow from your lender. Typically, the loan amount is about 75% to 95% of the.

Loan Against Property Easy loans, Poster, Movie posters

Loan against property (LAP) is a type of loan facility availed by individuals and businesses against the mortgage of a commercial or residential property. It is a secured loan, where.

How do I find out the loan against the property? Loan Trivia

The rate of interest for loan against property is 10% to 16%. However, for personal loan it is 11% to 21%. The equated monthly installments are higher for personal loans and cheaper for loan against property. Loan against property is a secured loan because a security is given. Personal loan is an unsecured loan.

How to Determine the Ideal Tenure of Your Loan Against Property HazelNews

If you have a fully constructed residential or commercial property without any other encumbrances, a Loan Against Property is the best option compared to any other type of loan. It offers large sums of money for a lower rate of interest as the loan is secured by the collateral, your property. Some banks also provide a LAP with an overdraft.

Loan Against Property Service, in Pan India, 1000010000000 ID 24170355191

Loan Against Property Whether you own a residential, commercial or special use property, it is an asset that can be used as collateral against a loan, when you have a financial requirement.

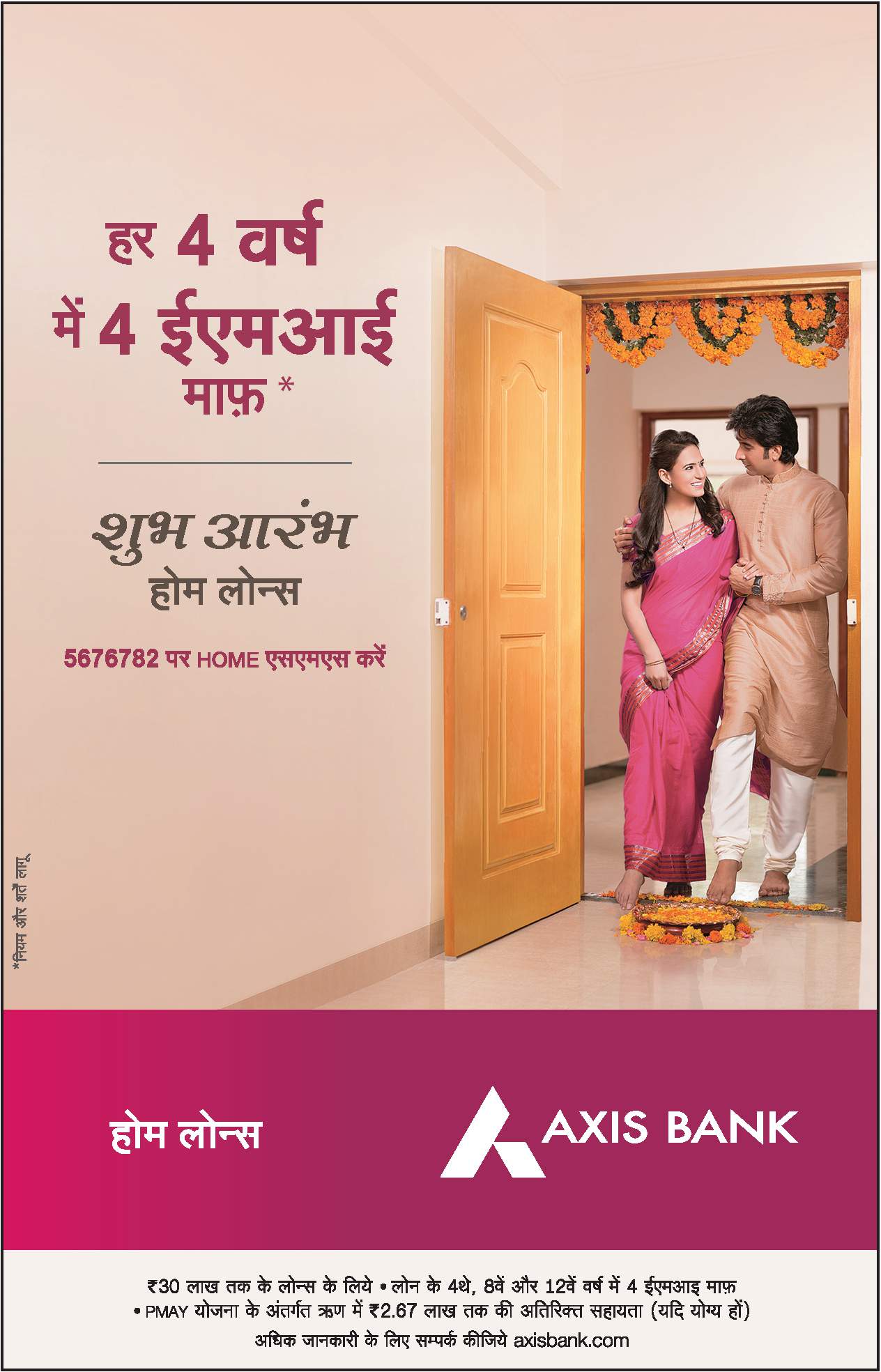

Axis Bank Home Loans Har 4 Varsh Mei 4 Emi Saaf Ad Advert Gallery

Axis Bank offers easy and hassle-free Loan against Property for a loan amount starting from Rs. 5 Lakhs. You can avail loan against residential or commercial properties at attractive rates of interest and earn eDGE Loyalty Reward points. Submit Online Application.

Bharat Bank

Loan against Property (LAP), also known as mortgage loan, allows consumers to raise funds by leveraging their residential, commercial or industrial properties. Like unsecured personal loans, LAP can also be availed for meeting both personal and business needs other than speculative purposes.

Loan Against Property in LIC SQUARE, Nagpur ID 2849909338012

A lien is a legal claim against a piece of property that is recorded with the local county, giving the lienholder a legal interest in a property. Liens are generally granted by a property.

A Beginner's Guide on Understanding Various Loan Against Property Interest Rates & Charges

The term "floating loan against property rate of interest" refers to a financing arrangement in which the interest rate fluctuates in response to external factors such as the Reserve Bank of India's (RBI) benchmark rate, inflation, market conditions, etc. When the RBI raises the base rate, the floating rate rises in line, and vice versa.

Home Loan in Delhi, घर के लिए ऋण, दिल्ली

October 23rd, 2023 Why use LendingTree? Similar to home equity, land equity is the value of your land minus any money you owe on the loan used to purchase it. With a land equity loan, you can turn that equity into cash without having to sell the land itself.

Loan Against Property Services at Rs 50000000/service संपत्ति के खिलाफ ऋण, लोन अगेंस्ट

A loan against property is a loan which uses your home as collateral. It's usually used for things like home improvements, as an alternative to taking out a personal loan, or using your credit card . You can only take out a loan against your property if you own all or part of your home (known as the equity in your property.)

Loan Against Property from MFB offers a higher loan amount Loan, Home loans, Creative posters

Mortgage applications surged by 9.9% in the first week of the year, a sign that lower rates are bringing homebuyers off the sidelines, according to a report released Wednesday by the Mortgage.

Apply Loan against Property Online Tax Robo

A loan against property is a flexible and secure way of borrowing funds for personal or business expenses. It offers a lower interest rate and a higher loan amount than other unsecured loans, making it an attractive option for borrowers. However, as the loan is secured by the borrower's property, defaulting on repayments can lead to the loss.