How VAT works and is collected (valueadded tax) Perfmatters

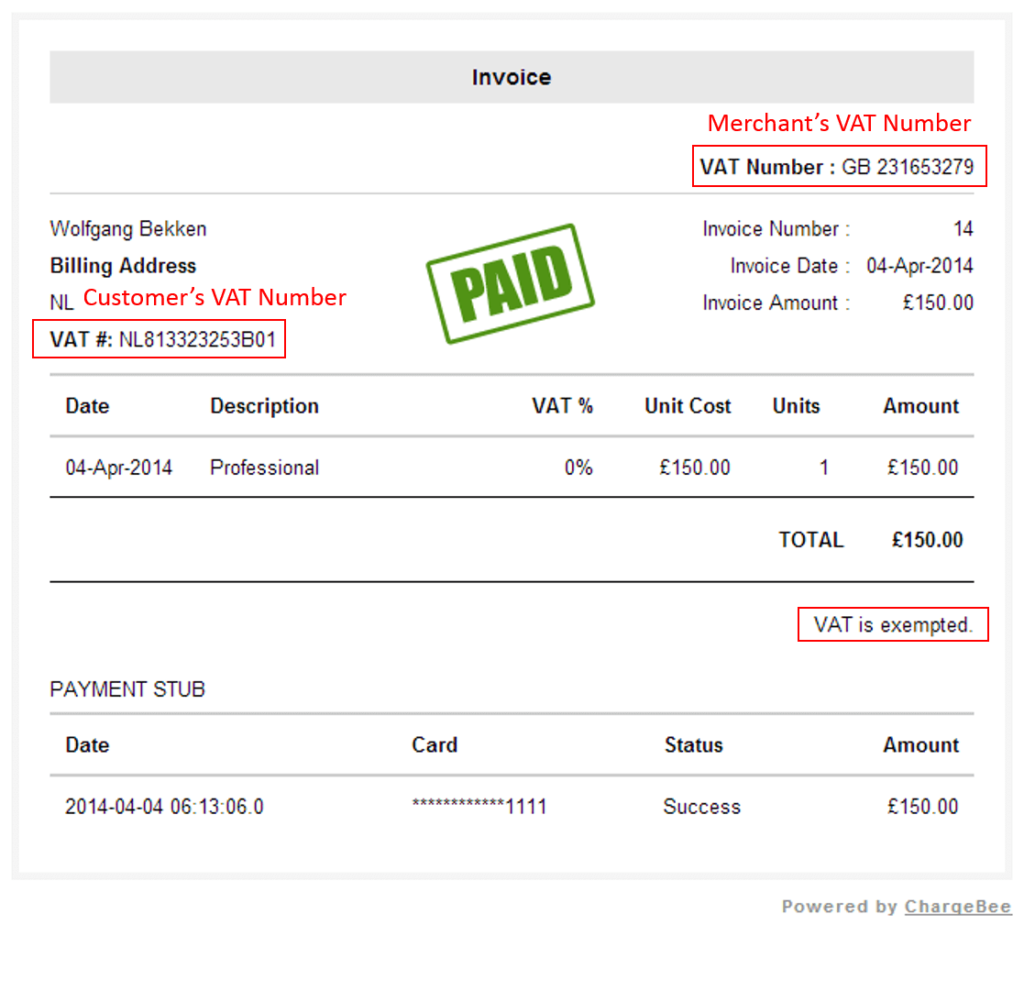

VAT tax number: meaning and format. Value-added tax identification number (VATIN), or simply VAT, is a unique identifier used by the government that links to every taxable person or registered business. A VAT number allows tax authorities in the EU to track the movement of goods and associated tax liabilities on trading businesses.

How to Find a Business’s VAT Number? CruseBurke

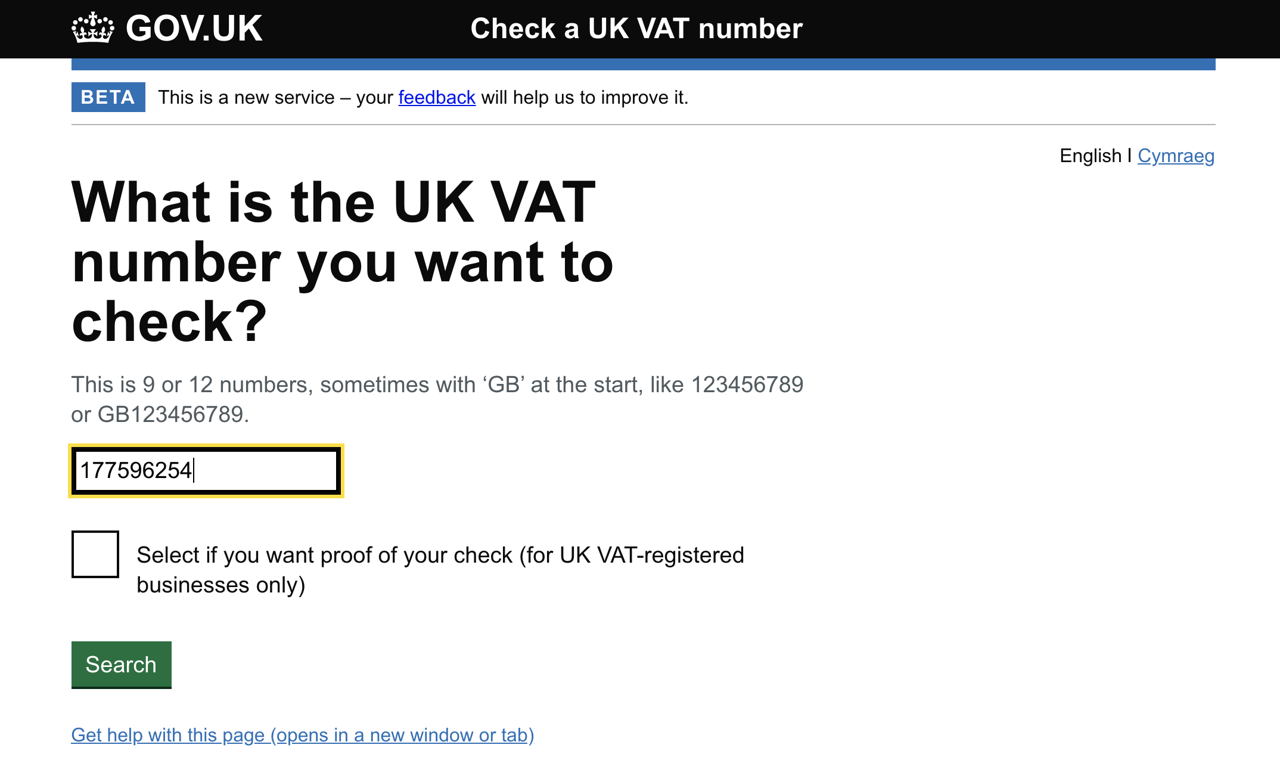

VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission. The data is retrieved from national VAT databases when a search is made from the VIES tool.

How to find a business's VAT number? Experlu

A VAT or value-added tax identification number is a unique identity granted to firms operating in areas with a value-added tax system. This number enables organizations to engage in international commerce and transactions inside the EU (European Union) or other VAT-implementing sites.

Gov.uk Vat / Vat stands for value added tax. Jaleada Mapanfu

What is a VAT ID? The VAT Identification number identifies all companies in the European Union and is indispensable for intra-European trade. It can be obtained by registering vor VAT. When trading within the EU (intra-community supply/service) a VAT ID for making sure that taxes are paid is mandatory.

AskTheTaxWhiz VAT or nonVAT taxpayer?

[1] Example: VAT numbers for Germany start with the letters "DE" and are followed by 9 digits, such as DE123456789. Example: The VAT country code for Estonia is EE, so an Estonian business's VAT number may look like EE93810511 The letters at the start of a VAT number may change based on the language you're using.

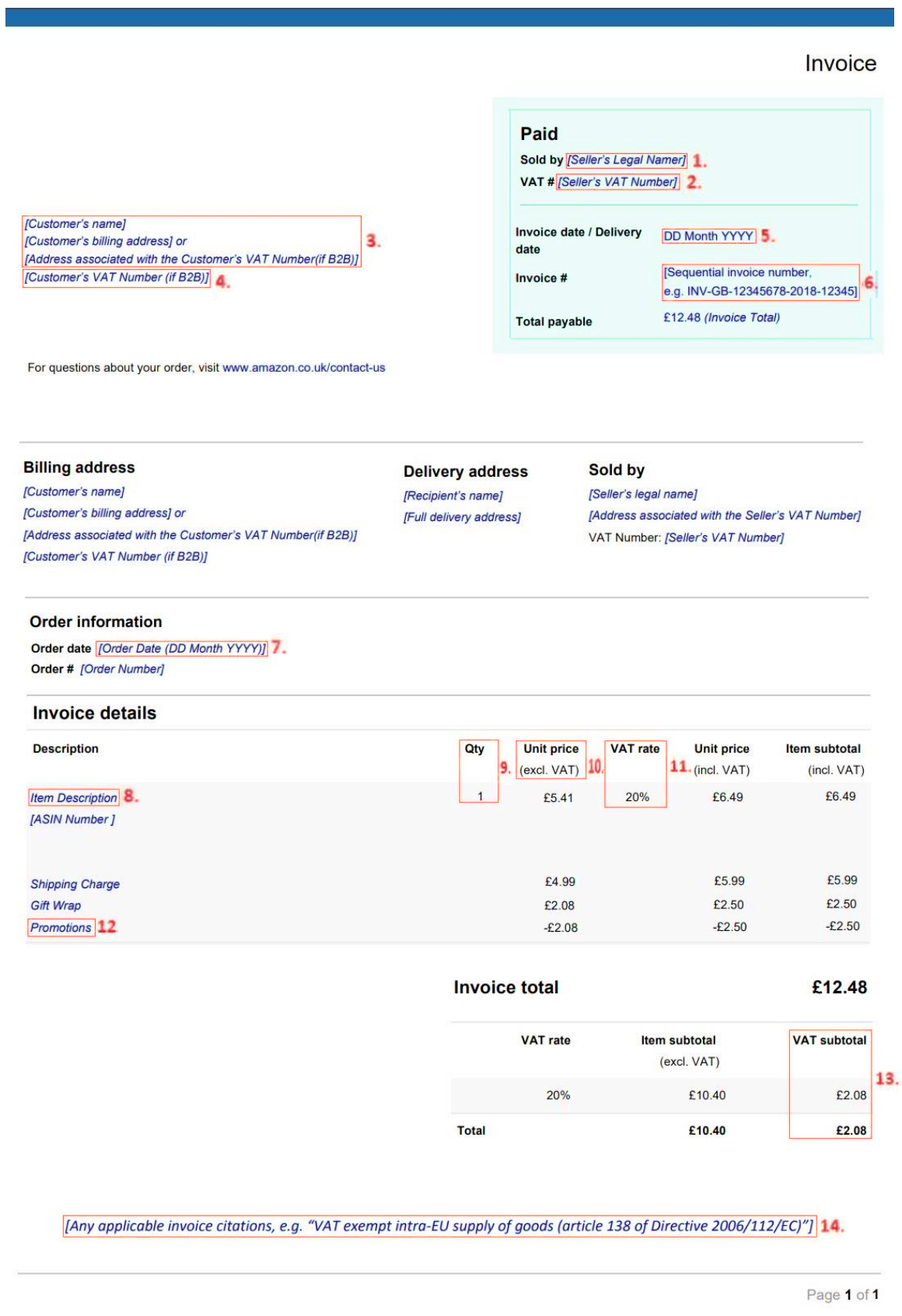

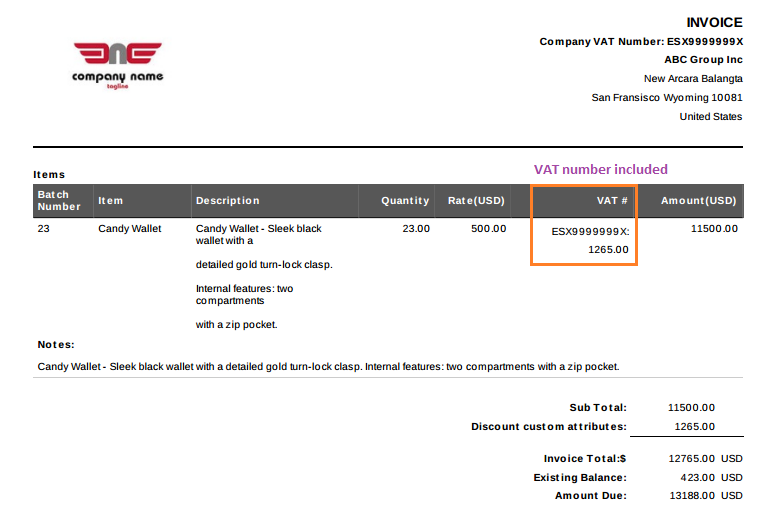

A ValueAdded Tax (VAT) Invoice GeekSeller Support

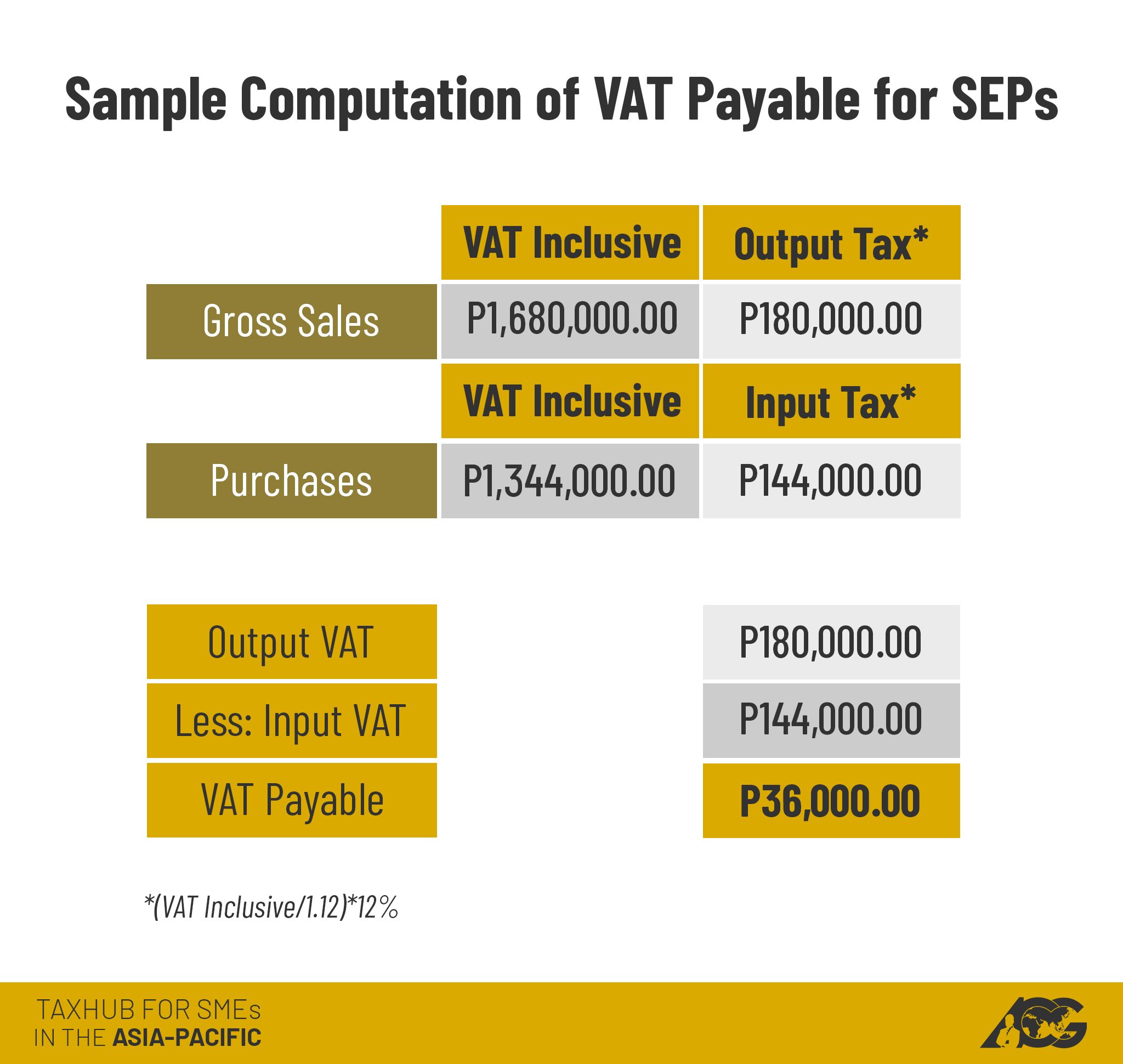

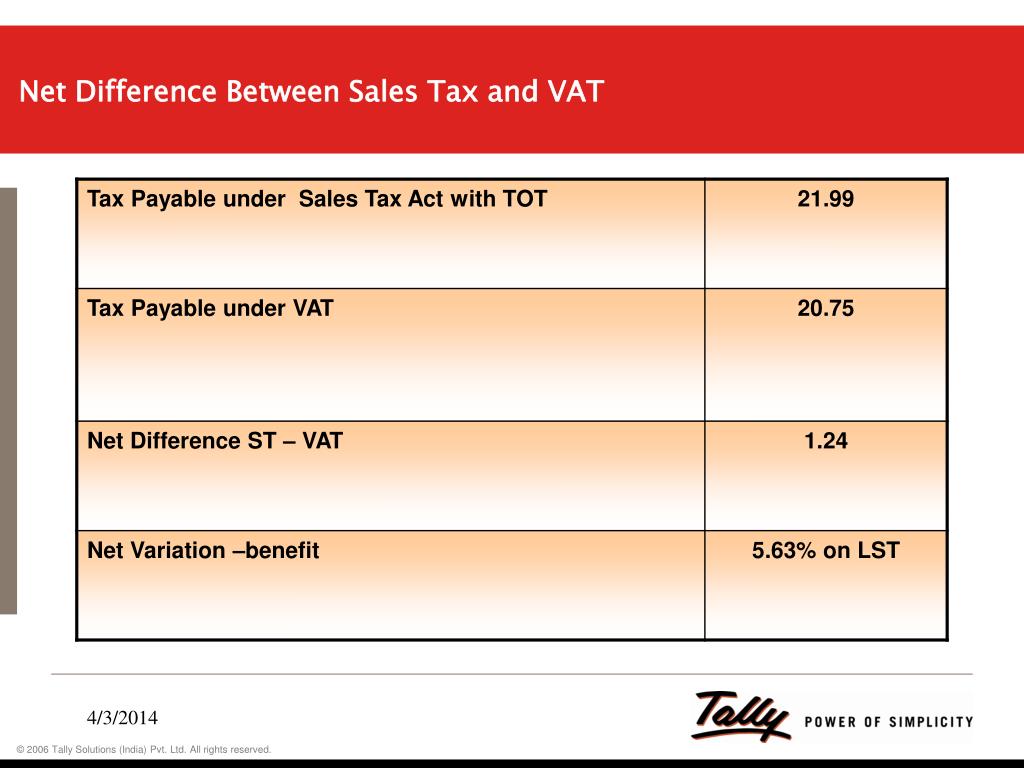

Both sales tax and VAT are types of indirect tax - a tax collected by the seller who charges the buyer at the time of purchase and then pays or remits the tax to the government on behalf of the buyer. Sales tax and VAT are a common cause of confusion within the corporate tax community.

VAT Return Get hands on help with your VAT Return

What is a VAT number and how can I get one? Getting a VAT number means obtaining a tax identification number in a foreign country to carry out trading taxable activities. You should not confuse getting a VAT number with setting up a branch (permanent establishment) or incorporating a subsidiary.

VAT invoice requirements Tide Business

A: No, an Income Tax Number and VAT number are two totally different tax types. Income tax registration is compulsory whereas a VAT registration number depends on quite a few factors. The business must however be registered for income tax before a tax clearance or VAT number can be applied for.

PPT VAT Accounting PowerPoint Presentation, free download ID771468

For example, if a product costs $100 and there is a 15% VAT, the consumer pays $115 to the merchant. The merchant keeps $100 and remits $15 to the government. The VAT system is used in 174.

Value Added Tax (VAT) Information & FAQ Nexcess

Value-added tax (VAT) is a broad consumption tax assessed on the value added to goods and services as they move through the supply chain. This includes labor and compensation charges, interest payments, and profits as well as materials. As with other consumption taxes, including goods and services tax (GST) or retail sales taxes, consumers pay value-added tax.

How VAT works and is collected (valueadded tax) Novashare

A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website.

VATnumber. What is that and how to get it? CloudOffice

What is a VAT identification number? Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that is registered for VAT. Check whether a VAT number is valid Check how VAT number is called in national language of each EU country Who needs a VAT number?

How to Add VAT number to your Etsy Account VAT Etsy UK Etsy UK Sales Tax es65 YouTube

VAT registration number. Also known as a VAT registration number or VRN, your number is assigned when you register your business for taxes. So, it will appear on the tax registration documents you receive from the member state where you've registered. The registration number can have between 4 and 15 digits total.

Include VAT Number In Invoices

What is a VAT number? The value added tax registration number (abbreviated 'VAT number', or 'VAT reg no.') is the individual identification number of companies that operate internationally within the EU. A VAT number enables international tax authorities to track and tax the transactions of these companies.

The Ultimate Guide to EU VAT for Digital Taxes

Value-added tax (VAT) is the international alternative to U.S. sales tax and is applied to the sale of goods and services in over 160 countries. However, VAT tax is more complex than simple sales tax.

What is a VAT number?

This document list downs the local name of the VAT numbers and its formats. 9 characters. The first character is always 'U'. le numéro d'identification ą la taxe sur la valeur ajoutée BTW - identificatienummer (BTW, TVA, NWSt) 10 characters. Prefix with zero '0' if the customer provides a 9 digit VAT number.